US Treasury Sec Bessent accused of contradictory mortgage pledges: Report | Housing News | Al Jazeera

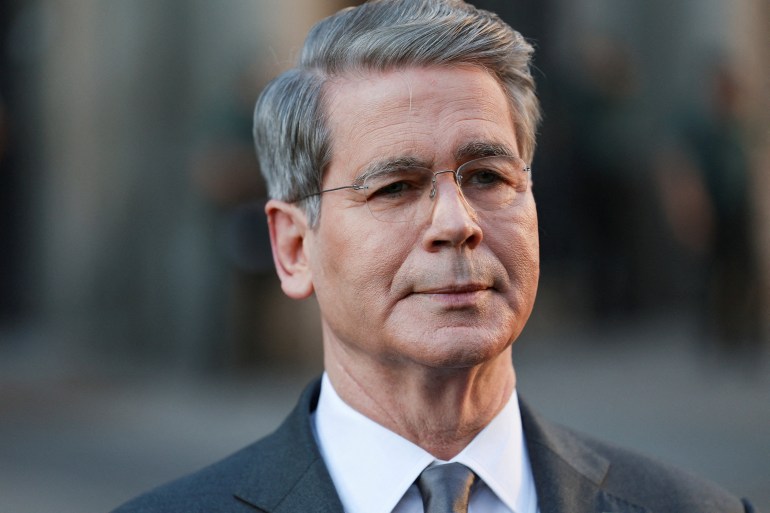

Allegations of Contradictory Mortgage Pledges Surround US Treasury Secretary Scott Bessent

Recent reports have emerged accusing U.S. Treasury Secretary Scott Bessent of making contradictory pledges regarding his mortgage agreements, raising questions about his integrity in connection with ongoing political scrutiny surrounding mortgage fraud allegations. The situation unfolds against a backdrop of heightened tensions within the federal government, particularly concerning the Federal Reserve and its officials.

Context of the Allegations

In an August 27 interview with Fox Business Network, Bessent commented on the accusations of mortgage fraud directed at Federal Reserve Governor Lisa Cook. He stated, “There are people who think that President Trump is putting undue pressure on the Fed. And there are people like President Trump and myself who think that if a Fed official committed mortgage fraud, that this should be examined, and that they shouldn’t be serving as one of the nation’s leading financial regulators.” This statement reflects the broader political climate, where the Trump administration has been vocal about perceived misconduct within the Federal Reserve.

Under the Federal Reserve Act of 1913, the central bank was designed to be insulated from political interference. The law stipulates that Fed governors can only be removed by the president “for cause,” although it does not define what constitutes “cause” nor does it outline the procedures for such a removal. Historically, no president has ever dismissed a Fed governor, making this situation particularly unprecedented.

Specifics of the Mortgage Agreements

The controversy surrounding Bessent centers on mortgage documents that reveal he pledged to occupy two different properties as his “principal residence.” These properties are located in Bedford Hills, New York, and Provincetown, Massachusetts. The details of these agreements were highlighted in a report by Bloomberg, which indicated that a lawyer acting on Bessent’s behalf made these commitments on September 20, 2007.

The allegations against Bessent are compounded by similar claims against Lisa Cook, who has been accused of declaring a property in Atlanta as a “vacation home” while also receiving tax breaks for another residence in Ann Arbor, Michigan, which she had designated as her primary home. Public records reviewed by Reuters confirmed that Cook had not violated any regulations concerning tax breaks.

Broader Implications and Political Ramifications

Bessent is not the only individual linked to these allegations. Bill Pulte, who was appointed by Trump as the director of the Federal Housing Finance Agency, has also faced scrutiny over similar claims. Close relatives of Pulte reportedly have claimed homestead exemptions for properties in both Michigan and Florida, raising further questions about the integrity of mortgage declarations among high-ranking officials.

The political implications of these allegations are significant. President Trump has been actively seeking to remove Cook from her position, citing the alleged mortgage fraud as justification. However, a U.S. appeals court recently declined to permit Trump to dismiss Cook, a decision that the White House has indicated will be appealed to the U.S. Supreme Court.

In addition to the political maneuvering, the Department of Justice has initiated a criminal investigation into Cook’s mortgage filings, reportedly issuing grand jury subpoenas in both Georgia and Michigan. These developments underscore the seriousness of the allegations and the potential ramifications for those involved.

Expert Opinions on the Matter

Mortgage experts consulted by Bloomberg have indicated that there is no evidence of wrongdoing or fraudulent activity in Bessent’s mortgage filings. They noted that discrepancies in such documents are not uncommon and do not necessarily imply any illegal behavior. Furthermore, Bank of America, the lender involved in Bessent’s mortgages, did not rely on his pledges to occupy both homes as primary residences, suggesting that the bank did not expect such an arrangement to be feasible.

The homestead exemption that is at the center of these allegations is designed to provide tax relief to homeowners for properties they occupy as their primary residences. The misuse of such exemptions can lead to significant legal and financial consequences, making the scrutiny of these claims all the more critical.

Conclusion

The allegations against Treasury Secretary Scott Bessent regarding contradictory mortgage pledges highlight ongoing tensions within the U.S. government and raise important questions about accountability among public officials. As investigations continue and political battles unfold, the implications of these claims could have far-reaching effects on the individuals involved and the broader political landscape.

Key Facts

– Scott Bessent, U.S. Treasury Secretary, is accused of making contradictory mortgage pledges regarding two properties.

– Bessent’s statements came amid allegations against Fed Governor Lisa Cook, who faces similar accusations of mortgage fraud.

– The Federal Reserve Act of 1913 protects Fed governors from political interference but does not define the grounds for removal.

– Mortgage documents indicate Bessent pledged to occupy homes in New York and Massachusetts as his principal residence.

– The Department of Justice has launched a criminal investigation into Cook’s mortgage filings, issuing grand jury subpoenas.

– Experts have found no evidence of wrongdoing in Bessent’s mortgage filings, highlighting the complexity of such cases.

Source: www.aljazeera.com